DPHARMA: Reaping the Rewards of a Strong Ringgit

This article will be posted on the i3investor website at noon. Subscribers on Substack will be able to read it first here.

This article will be posted on the i3investor website at noon. Subscribers on Substack will be able to read it first here.

Stock Background:

Duopharma Berhad is a leading pharmaceutical company in Malaysia, specializing in the development, manufacturing, and distribution of medicines, health supplements and healthcare tools.

Theme for the stock:

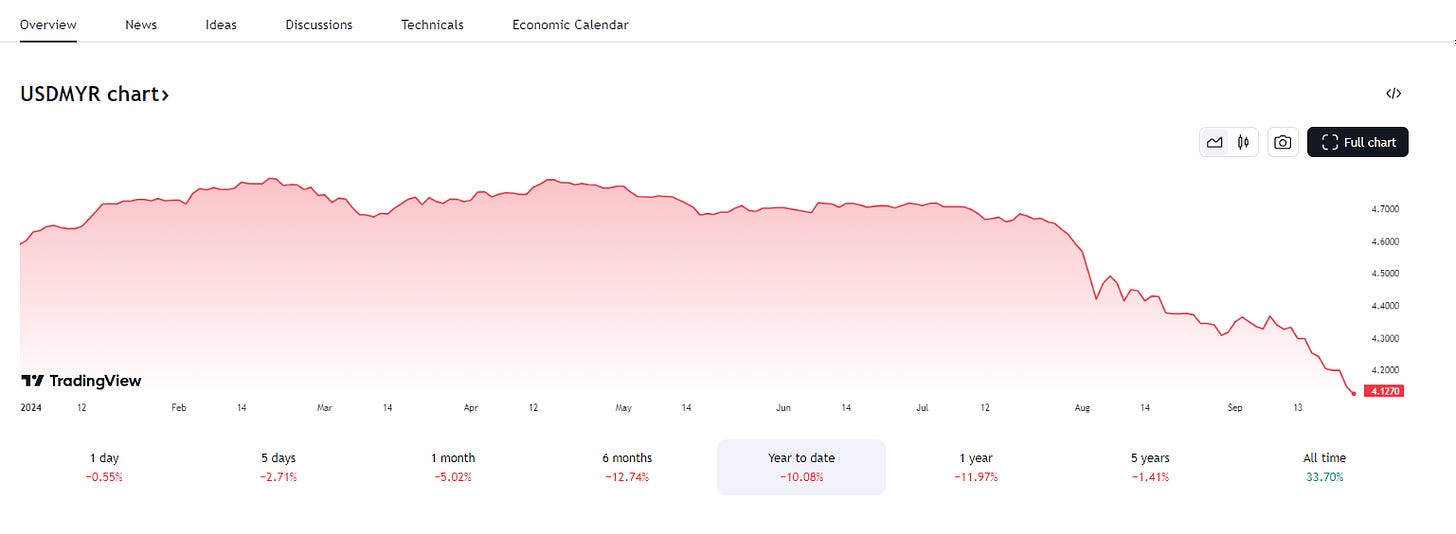

Beneficiary of Strong Ringgit. Almost all sales are in Ringgit. Most of the company’s cost is denominated in USD. In short, margin will improve. As shown in the chart below from TradingView, Ringgit has appreciated 10% YTD and 13% in the past year.

Strong Market Position: As a leading player in the Malaysian pharmaceutical sector, Duopharma has a solid market presence, which can drive steady revenue growth.

Diverse Product Portfolio: With a wide range of generic and proprietary medicines, the company can cater to various therapeutic areas, reducing reliance on any single product line.

Overall Technical Verdict: The stock shows a strong technical setup with bullish signals, supported by rising volume and positive indicators. However, the stock is at overbought levels.

Details of Technical Analysis

Moving Averages: The stock has crossed above the key moving averages (50, 150, and 200-day MAs), showing a strong bullish signal.

Bollinger Bands: The stock has broken above the upper Bollinger Band, indicating strong upward momentum. However, this could also suggest a short-term overbought condition.

RSI (Relative Strength Index): The RSI is around 58, suggesting there is still room for more upside before it becomes overbought.

MACD: The MACD shows a bullish crossover, indicating a possible continuation of upward momentum.

Volume: There's a noticeable volume spike during the breakout, which reinforces the strength of the current movement.