APOLLO: Strong Fundamentals Amidst a Neutral Technical Setup - Is It A Time To Buy?

Fundamental Outlook: Undervalued By 10%-15%

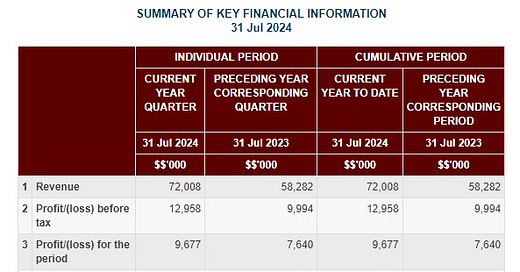

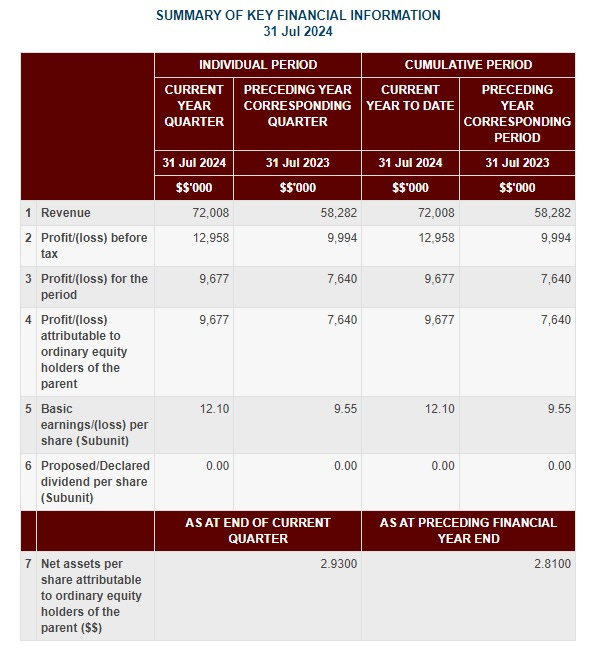

1. Earnings surge 27% YoY and 57% QoQ. This is due to strong improvement in sales by 24% YoY and 26% QoQ. Both domestic and export market outperformed. It seems like the new management is bringing the company to new growth by implementing proactive marketing strategy.

2. No dividend for this quarter. However, no…

Keep reading with a 7-day free trial

Subscribe to KingKKK’s Substack to keep reading this post and get 7 days of free access to the full post archives.